by our College Data Analytics Team

by our College Data Analytics TeamWe've gathered data and other essential information about the program, such as the ethnicity of students, how many students graduated in recent times, and more. We've also included details on how Golden Gate University - San Francisco ranks compared to other colleges offering a major in taxation.

Jump to any of the following sections:

Golden Gate University - San Francisco is in the top 10% of the country for taxation. More specifically it was ranked #4 out of 34 schools by College Factual.

In 2022, 95 students received their master’s degree in taxation from Golden Gate University - San Francisco. This makes it the #2 most popular school for taxation master’s degree candidates in the country.

During the 2022-2023 academic year, part-time undergraduate students at Golden Gate University - San Francisco paid an average of $418 per credit hour. No discount was available for in-state students. Information about average full-time undergraduate tuition and fees is shown in the table below.

| In State | Out of State | |

|---|---|---|

| Tuition | $11,088 | $11,088 |

| Fees | $255 | $255 |

| Books and Supplies | $1,920 | $1,920 |

Learn more about Golden Gate University - San Francisco tuition and fees.

Golden Gate University - San Francisco does not offer an online option for its taxation bachelor’s degree program at this time. To see if the school offers distance learning options in other areas, visit the Golden Gate University - San Francisco Online Learning page.

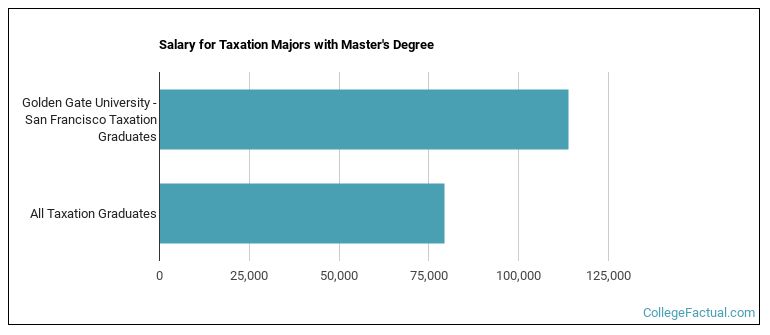

Taxation majors graduating with a master's degree from Golden Gate University - San Francisco make a median salary of $113,936 a year. This is a better than average outcome since the median salary for all taxation graduates with a master's is $79,313.

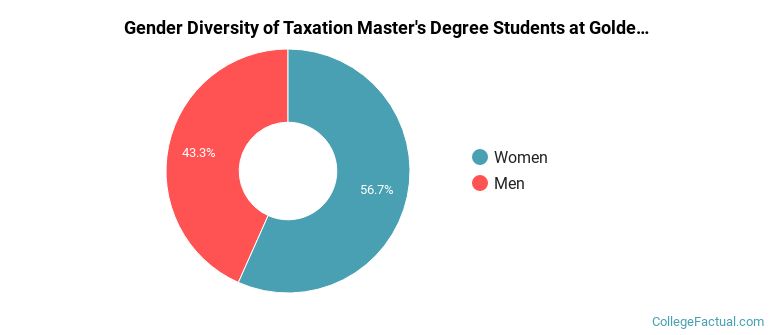

During the 2021-2022 academic year, 90 students graduated with a master's degree in taxation from Golden Gate University - San Francisco. About 43% were men and 57% were women.

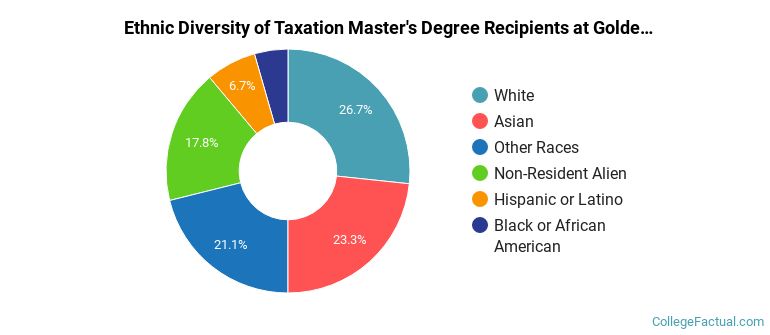

The following table and chart show the ethnic background for students who recently graduated from Golden Gate University - San Francisco with a master's in taxation.

| Ethnic Background | Number of Students |

|---|---|

| Asian | 21 |

| Black or African American | 4 |

| Hispanic or Latino | 6 |

| White | 24 |

| Non-Resident Aliens | 16 |

| Other Races | 19 |

Take a look at the following statistics related to the make-up of the taxation majors at Golden Gate University - San Francisco.

| Related Major | Annual Graduates |

|---|---|

| Business Administration & Management | 301 |

| Human Resource Management | 93 |

| Accounting | 44 |

| Management Sciences & Quantitative Methods | 37 |

| Finance & Financial Management | 31 |

More about our data sources and methodologies.