by our College Data Analytics Team

by our College Data Analytics TeamWe've gathered data and other essential information about the program, such as the ethnicity of students, how many students graduated in recent times, and more. We've also included details on how Villanova ranks compared to other colleges offering a major in taxation.

Go directly to any of the following sections:

In College Factual's most recent rankings for the best schools for taxation majors, Villanova came in at #2. This puts it in the top 5% of the country in this field of study.

In 2022, 60 students received their master’s degree in taxation from Villanova. This makes it the #3 most popular school for taxation master’s degree candidates in the country.

During the 2022-2023 academic year, part-time undergraduate students at Villanova paid an average of $1,010 per credit hour. No discount was available for in-state students. The following table shows the average full-time tuition and fees for undergraduates.

| In State | Out of State | |

|---|---|---|

| Tuition | $63,806 | $63,806 |

| Fees | $895 | $895 |

| Books and Supplies | $1,100 | $1,100 |

| On Campus Room and Board | $16,896 | $16,896 |

| On Campus Other Expenses | $2,300 | $2,300 |

Learn more about Villanova tuition and fees.

Villanova does not offer an online option for its taxation bachelor’s degree program at this time. To see if the school offers distance learning options in other areas, visit the Villanova Online Learning page.

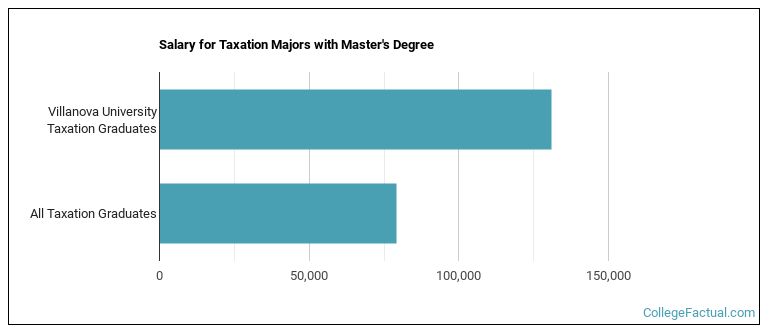

Graduates of the master's taxation program at Villanova make a median salary of $130,913. This is a better than average outcome since the median salary for all taxation graduates with a master's is $79,313.

| Related Major | Annual Graduates |

|---|---|

| Business Administration & Management | 299 |

| Human Resource Management | 286 |

| Finance & Financial Management | 231 |

| Management Sciences & Quantitative Methods | 197 |

| Accounting | 184 |

View All Taxation Related Majors >

More about our data sources and methodologies.