by our College Data Analytics Team

by our College Data Analytics TeamTaxation is a concentration offered under the taxation major at University of North Texas. Here, you’ll find out more about the major master’s degree program in taxation, including such details as the number of graduates, diversity of students, and more.

If there’s something special you’re looking for, you can use one of the links below to find it:

In 2019-2020, the average part-time graduate tuition at UNT was $868 per credit hour for out-of-state students. The average for in-state students was $459 per credit hour. The following table shows the average full-time tuition and fees for graduate student.

| In State | Out of State | |

|---|---|---|

| Tuition | $6,350 | $13,712 |

| Fees | $1,906 | $1,906 |

UNT does not offer an online option for its taxation master’s degree program at this time. To see if the school offers distance learning options in other areas, visit the UNT Online Learning page.

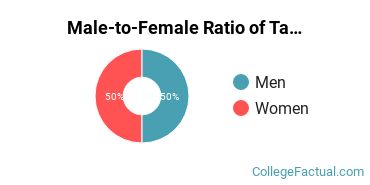

Of the students who received their master’s degree in taxation in 2019-2020, 50.0% of them were women. This is about the same as the countrywide number of 50.5%.

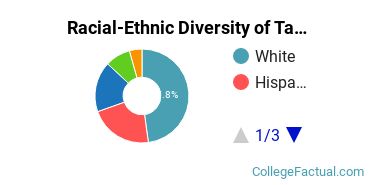

Of those graduates who received a master’s degree in taxation at UNT in 2019-2020, 47.8% were racial-ethnic minorities*. This is higher than the nationwide number of 33%.

| Race/Ethnicity | Number of Students |

|---|---|

| Asian | 8 |

| Black or African American | 0 |

| Hispanic or Latino | 10 |

| Native American or Alaska Native | 0 |

| Native Hawaiian or Pacific Islander | 0 |

| White | 22 |

| International Students | 2 |

| Other Races/Ethnicities | 4 |

*The racial-ethnic minorities count is calculated by taking the total number of students and subtracting white students, international students, and students whose race/ethnicity was unknown. This number is then divided by the total number of students at the school to obtain the racial-ethnic minorities percentage.

More about our data sources and methodologies.