by our College Data Analytics Team

by our College Data Analytics TeamTaxation is a concentration offered under the taxation major at Wayne State University. We’ve gathered data and other essential information about the master’s degree program in taxation, such as diversity of students, how many students graduated in recent times, and more.

You can jump to any section of this page using the links below:

During the 2019-2020 academic year, part-time graduate students at Wayne State paid an average of $1,470 per credit hour if they came to the school from out-of-state. In-state students paid a discounted rate of $679 per credit hour. The following table shows the average full-time tuition and fees for graduate student.

| In State | Out of State | |

|---|---|---|

| Tuition | $16,285 | $35,274 |

| Fees | $1,941 | $1,941 |

Online degrees for the Wayne State taxation master’s degree program are not available at this time. To see if the school offers distance learning options in other areas, visit the Wayne State Online Learning page.

Of the students who received their master’s degree in taxation in 2019-2020, none of them were women.

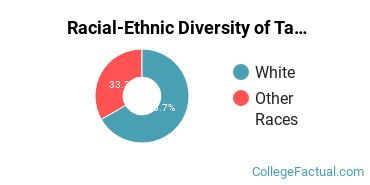

Of those graduates who received a master’s degree in taxation at Wayne State in 2019-2020, 33.3% were racial-ethnic minorities*. This is about the same as the nationwide number of 33%.

| Race/Ethnicity | Number of Students |

|---|---|

| Asian | 0 |

| Black or African American | 0 |

| Hispanic or Latino | 0 |

| Native American or Alaska Native | 0 |

| Native Hawaiian or Pacific Islander | 0 |

| White | 2 |

| International Students | 0 |

| Other Races/Ethnicities | 1 |

*The racial-ethnic minorities count is calculated by taking the total number of students and subtracting white students, international students, and students whose race/ethnicity was unknown. This number is then divided by the total number of students at the school to obtain the racial-ethnic minorities percentage.

More about our data sources and methodologies.